Time to be

your own boss

Time to be

your own boss

LLC plans start at $0 + filing fees.

LLC formed with LegalZoom in 2021

Use LegalZoom to start your business in 3 easy steps

Use LegalZoom to start your business in 3 easy steps

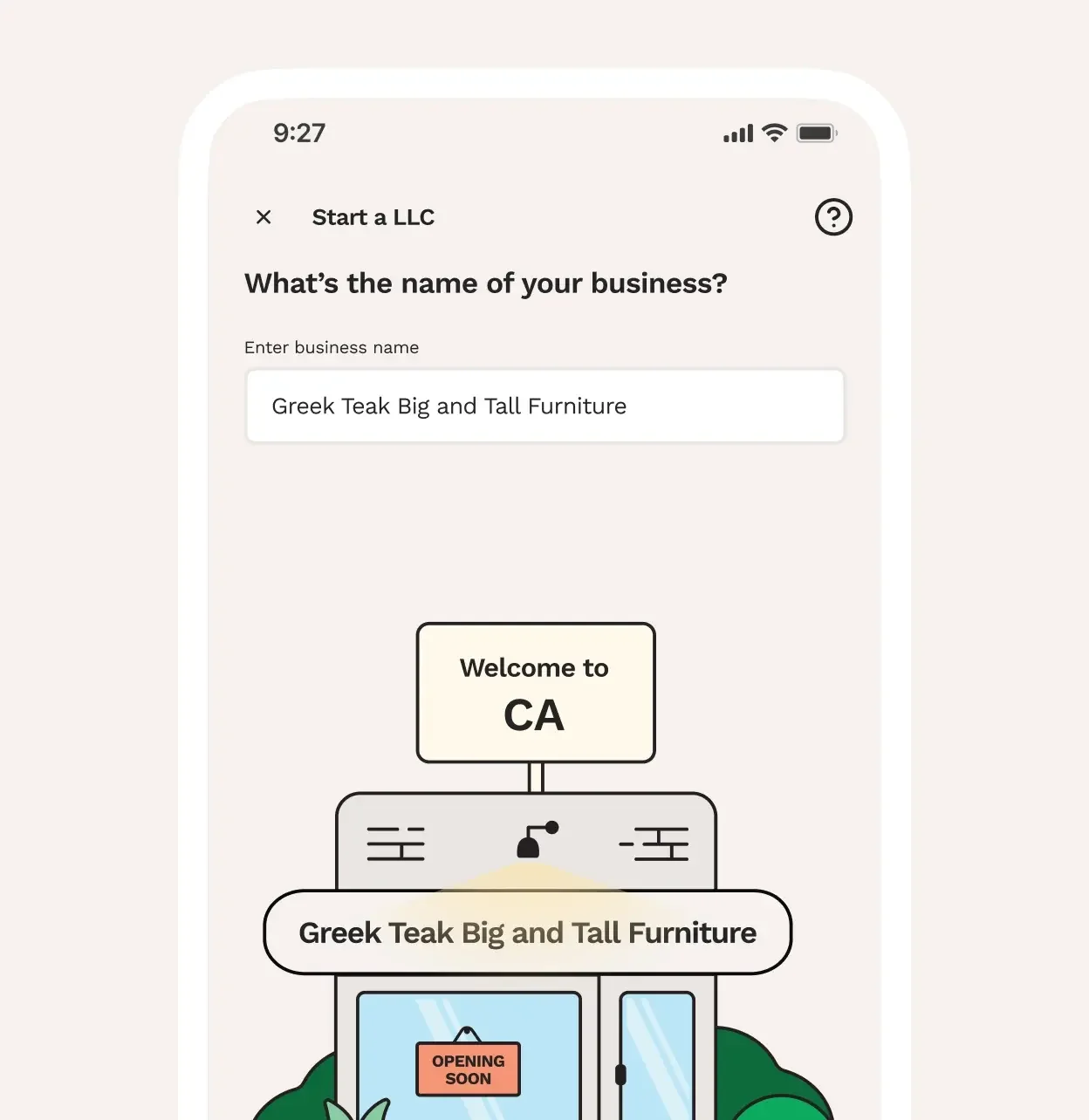

Choose a business structure and a business name

We'll help you get set up right, and we'll check with the state to make sure the name you want is available.

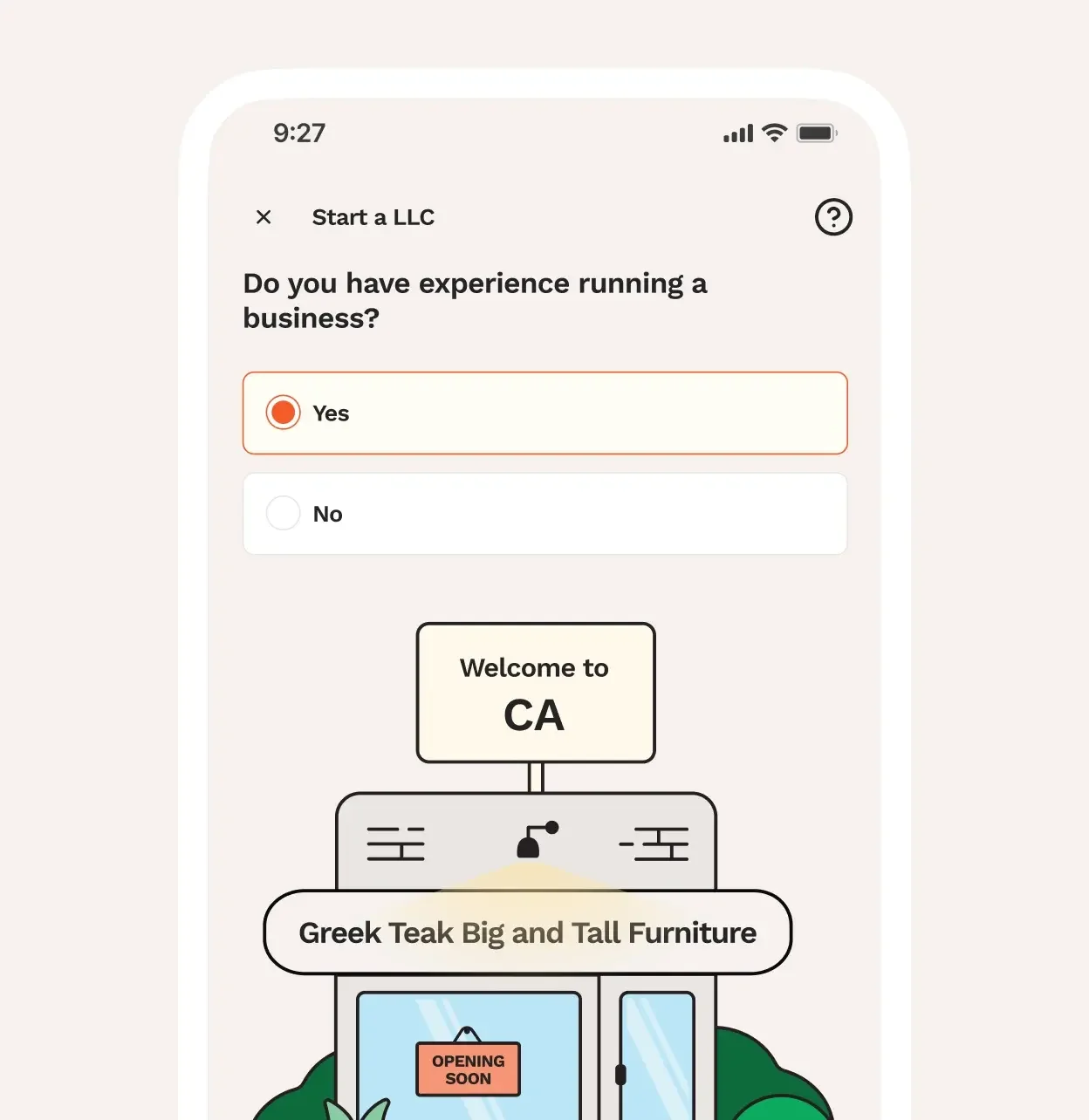

Answer a few questions about your business

Tell us all about the business you'd like to form, and we'll help make sure you have what you need to make your small business official and keep it compliant.

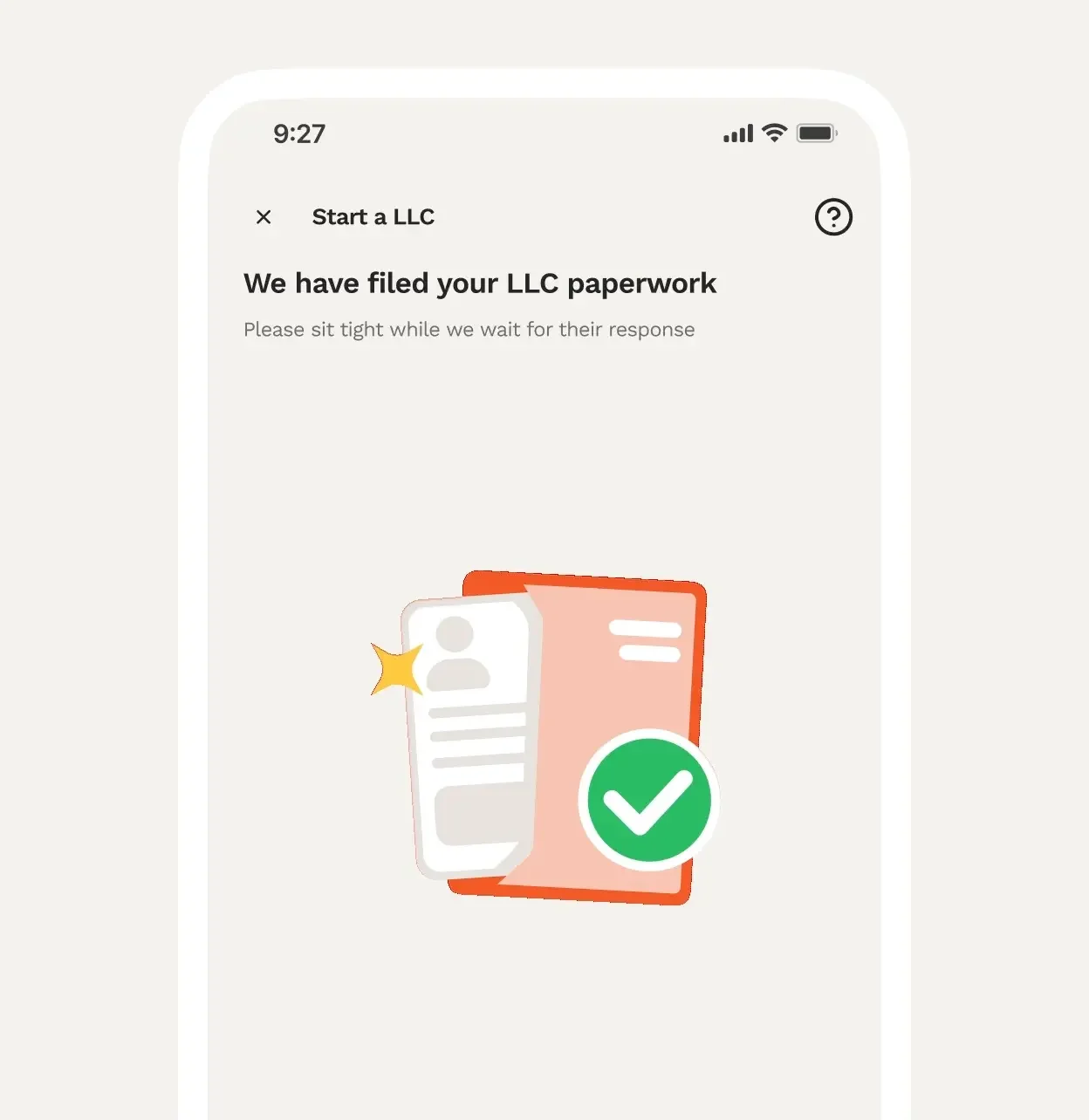

Sit tight while we file your paperwork

When your filing is approved, we'll upload your documents to your online account and your business will be off and running. It's that simple!

Sit tight while we file your paperwork

When your filing is approved, we'll upload your documents to your online account and your business will be off and running. It's that simple!

LegalZoom is a one-stop shop for entrepreneurs

Get the comprehensive tools you need to run and grow your business with confidence.

Explore small business services

With a full suite of bookkeeping products, you’ll never have any surprises at tax time.

Learn more about LZ Books

Get special offers from LegalZoom's trusted partners on a wide range of services like business banking, insurance, websites, and payment systems.

Discover your special offers

Explore protective services

Let our network of business attorneys save you time, money, and headaches.

Jonathan

18 years

April

10 years

April

10 years

Get your questions answered by our independent network of attorneys.

How we’ve helped

our customers

Anne

18 years

years